A payment gateway is a software application that facilitates online money transfers through multiple payment methods, including UPI, debit cards, net banking, and credit cards. Acting as a third-party service, it securely transfers funds from the buyer’s account to the merchant’s account. Below is a concise list of the top 10 payment gateways in India. Let’s see Leading Payment Gateways in India: Top 10 List.

India’s digital payment landscape is thriving, with several top-tier payment gateways facilitating secure and efficient transactions. Among the leading options are Paytm Business, Razorpay, PayU, and PayPal, each offering unique features tailored to different business needs. These gateways support various payment methods, including UPI, credit/debit cards, and net banking, making them essential for businesses aiming to reach a broad customer base.

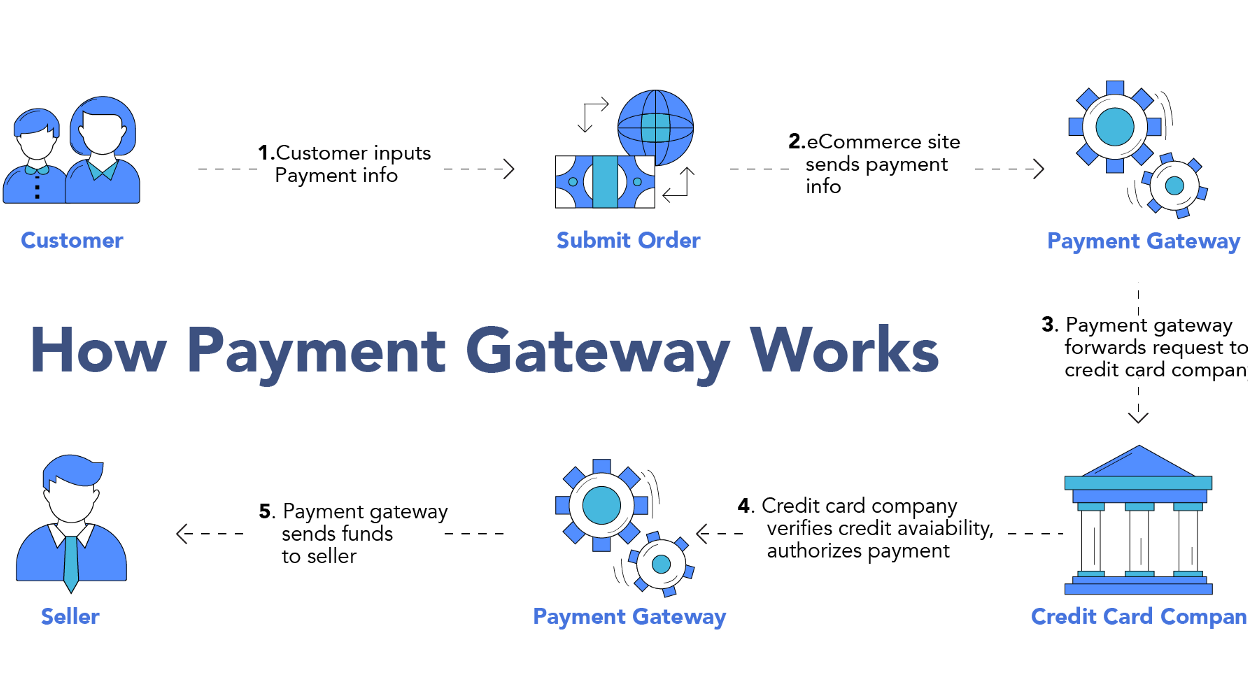

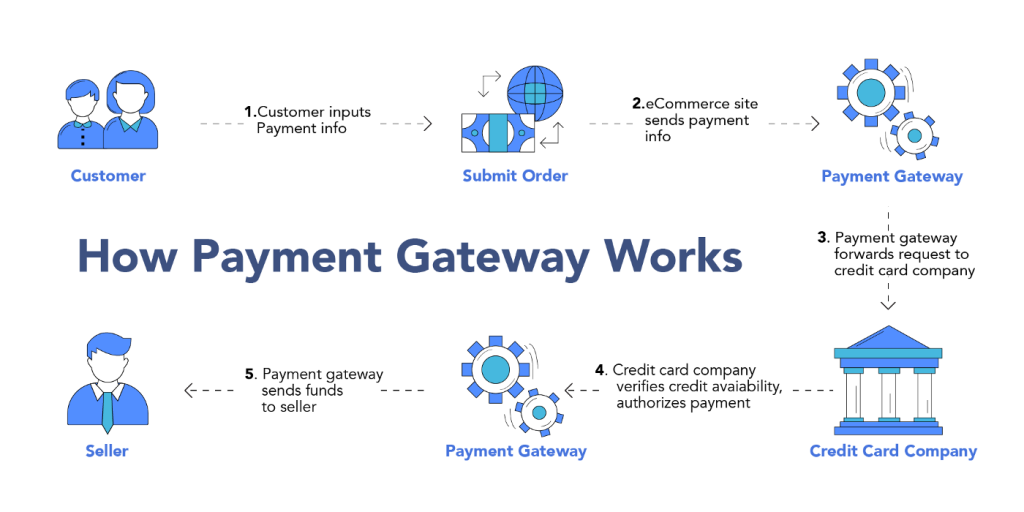

How does a typical payment gateway work?

When a buyer places an order on a website or app and clicks the submit button, they are redirected to a payment gateway. Here, the customer enters their bank or account details. Next, they are taken to a secure page to authorize the transaction. Once the transaction is approved, the bank verifies the account holder, and finally, the money is transferred to the seller.

Essential features of a payment gateway

Ensure a secure and seamless experience for buyers by checking these essential features before selecting a payment gateway.

Ability to handle sensitive data:

Payment gateways handle the most sensitive customer data, and mishandling this crucial information can lead to misuse. Therefore, it’s essential to consider the encryption standards of the payment gateway. Minimizing the risk of data breaches not only protects customer information but also helps reduce processing costs.

Detection of fraud:

Not all transactions on eCommerce platforms are genuine, so payment gateways must proactively detect fraud. Fraudulent activities can harm a business’s reputation. To mitigate these risks, payment gateways should implement the following measures:

- Device identification

- Payer authentication

- Lockout mechanisms

- Card verification value (CVV)

- Address verification service (AVS)

Costs and fees:

For a newly established business, incurring high costs on a payment gateway is often not feasible.

While some platforms may offer zero upfront costs, they might have high fees for chargebacks. Therefore, businesses should choose a payment gateway that offers maximum features without any hidden costs.

Compatibility:

Merchants often have unique requirements, such as integrating the payment gateway with invoicing software or other financial data management platforms. Therefore, a payment gateway should be compatible with various technological systems to meet these diverse needs.

Quick and global reach:

Businesses targeting global customers should integrate with a payment gateway that accepts international payments. Additionally, the transaction process should be quick and straightforward, as lengthy transaction times can reduce conversion rates.

Top Payment Gateways in India

Razorpay

Razorpay supports various payment modes, including mobile wallets, UPI, credit cards, and debit cards. Its dashboard analyzes real-time data to help businesses make informed decisions. Payment settlements take three days. Additionally, Razorpay’s financial CRM allows businesses to manage and track the flow of money to customers and employees.

Instamojo

Instamojo guarantees fast payments with a 99.9% success rate. Its payment gateway is PCI-DSS certified, ensuring the protection of both customers and merchants. Instamojo offers a free setup with no maintenance costs. In the event of transaction failures, it provides instant refunds.

CCAvenue

CCAvenue is one of India’s oldest and most trusted payment gateways, supporting around 200 payment options. It provides sellers with two interfaces: the shopping cart interface and the variable amount interface. Equipped with advanced technology, CCAvenue can handle a large volume of transactions daily.

Paytm

The payment gateway leverages advanced technology to ensure secure transactions, using AI to detect suspicious activities. It guarantees transaction settlements within 24 hours, reducing transaction time. Paytm offers customers a one-click checkout experience and is PCI-DSS certified with 128-bit encryption.

Juspay

Juspay is a reliable payment gateway offering express checkout and hosted payment methods. It reduces transaction time by speeding up page loading and boasts 99.99% uptime, lowering operational costs. Juspay developed the first Indian UPI platform, BHIM, and the UPI common library in partnership with NPCI. It processes over four million transactions per month for renowned brands.

BillDesk

BillDesk provides a variety of solutions for merchants, including financial services. It charges a transaction fee for each transaction and is available only to Indian customers. Payment settlements take approximately 3-5 days, and it offers limited payment options.

Cashfree

Cashfree is an integrated payment gateway with no initial setup or annual maintenance charges. It settles payments within 24 hours and supports domestic cards, internet banking, credit cards, and international payments. Cashfree provides live transaction reports, including settled and unsettled transactions, and offers an instant refund option for customers.

Paykun

Paykun features an easy-to-use interface and offers master payment links and payment link options. It supports partial refunds and accepts payments via debit cards, credit cards, MasterCard, net banking, digital wallets, and UPI. However, it does not support multi-currency transactions.

Mobikwik

Mobikwik requires two days for payment settlement, with zero withdrawal fees and negotiable annual maintenance charges. It supports all Indian and international MasterCards but does not offer multi-currency facilities. Mobikwik is integrated with Android, iOS, and Windows.

PayPal

PayPal operates in over 200 countries, facilitating transactions in more than 100 currencies and international credit cards. It has no withdrawal fees or annual maintenance charges, with daily payment settlements. PayPal also provides excellent customer support that is easy to reach.

Conclusion

The suitability of a payment gateway depends on a merchant’s specific needs. Popular options in India include Paytm, Mobikwik, PayPal, Juspay, Paykun, Cashfree, BillDesk, CCAvenue, Instamojo, and Razorpay. Select the one that best matches your requirements and offers the most benefits.